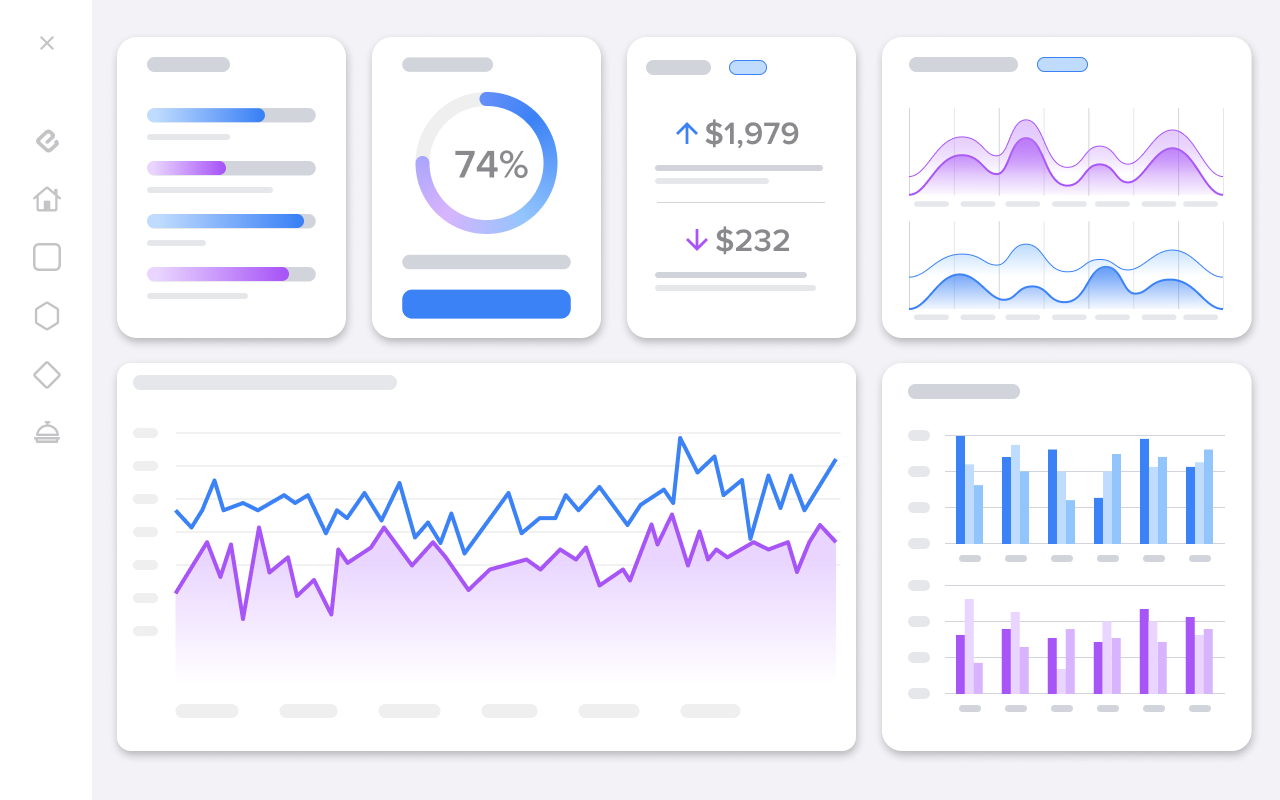

Turn Data into an Asset

Elementum enables helps data teams to automate any critical workflows in their financial institution. Improve client outcomes, minimize operational overhead, and effectively manage risk.

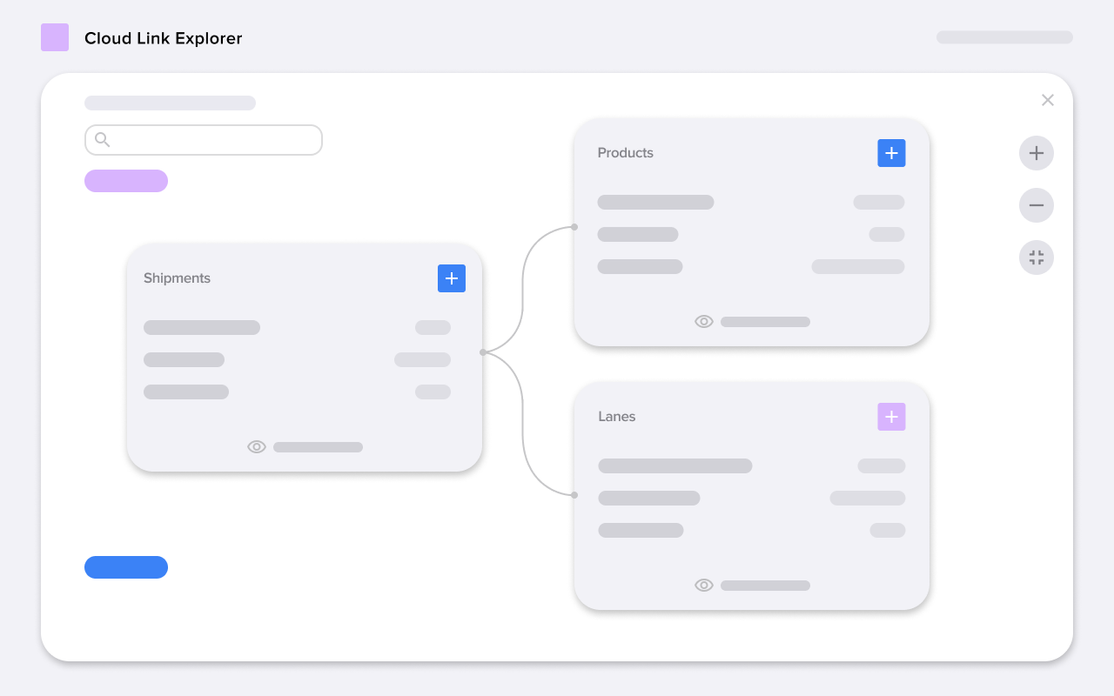

Get Started in Hours, Not Quarters

Set up and configure Elementum without engineering resources. Our no-code, zero-ETL platform enables you to:

- Go live in under 24 hours.

- Access 100s of pre-built workflows

- Realize 100% payback in 30 days or less

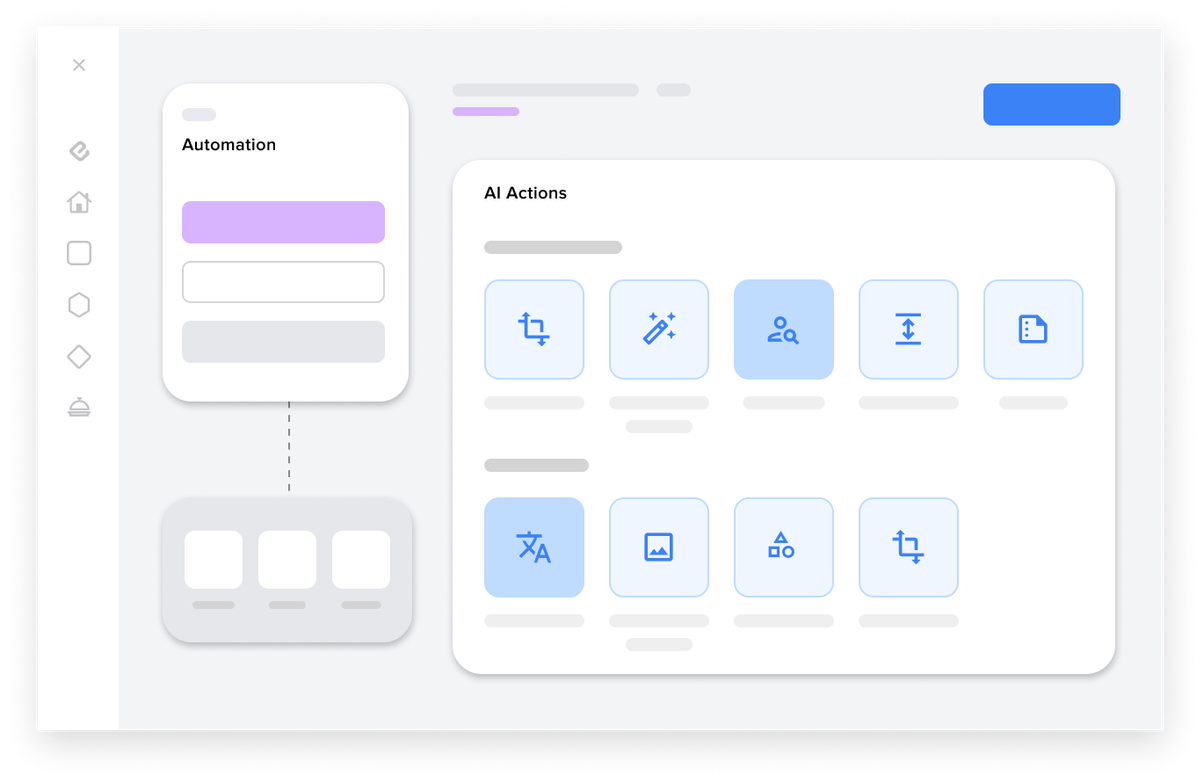

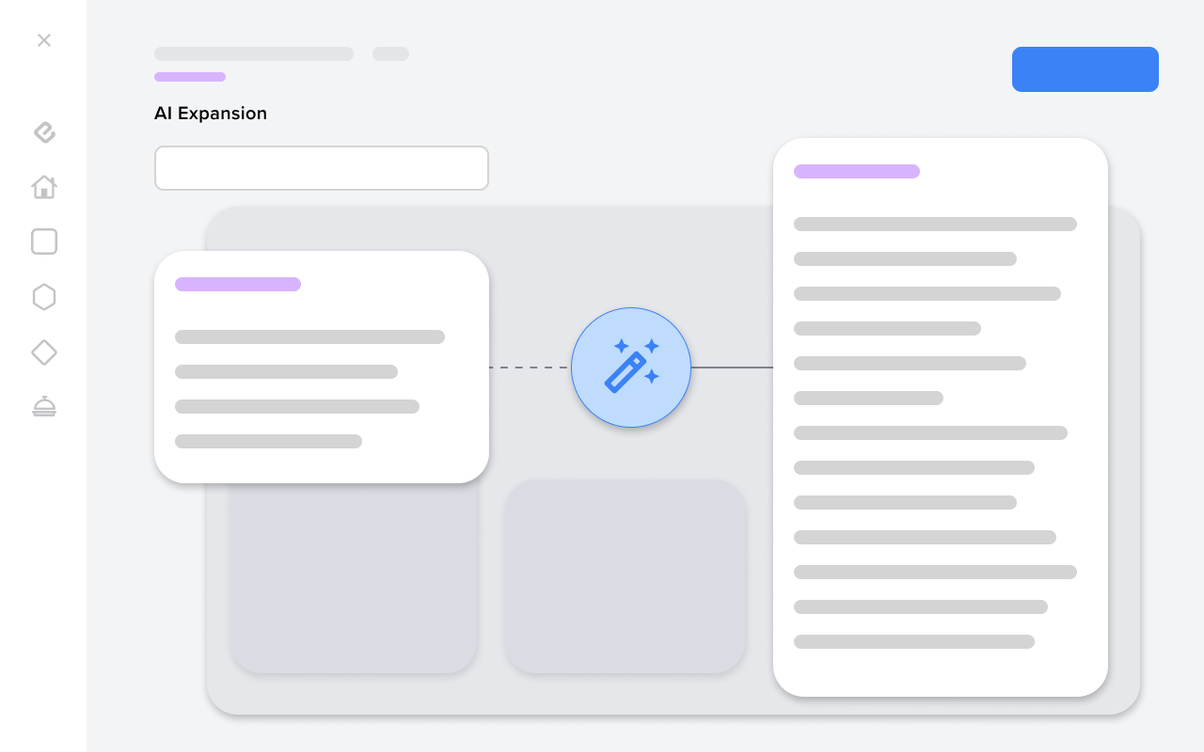

Make AI Work for You, Not the Other Way Around

Leverage AI, ML, and LLMs without data science expertise or complex infrastructure. With Elementum, you can:

- Use built-in models, third-party models, or bring your own

- Turn data into intelligent action instantly

- Use pre-trained LLMs to run your workflows

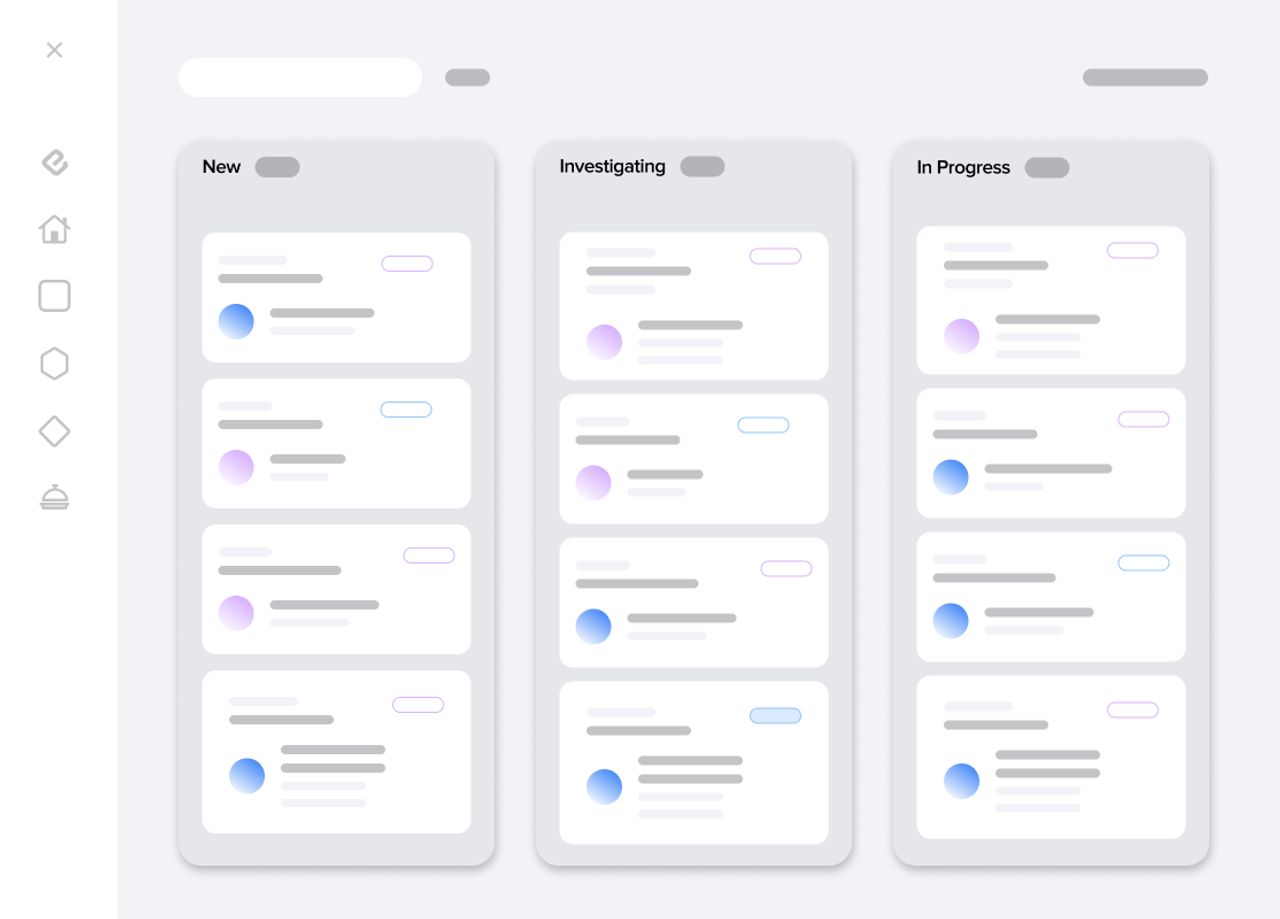

AI Driven Workflows for Financial Services

Elementum is the fastest, easiest way to automate any business process.

Automate Loans & Onboarding

Automate loan processing, fraud detection, and customer onboarding. Reduce back-office costs, improve turnaround times, and enhance customer trust.

Streamline Claims & Policies

Automate claims processing, risk assessment, and policy administration. Increase accuracy, minimize fraud, and deliver superior service to policyholders.

Simplify Compliance & Analysis

Automate compliance monitoring, portfolio analysis, and trade reconciliation. Enable your team to focus on strategic investment opportunities.

Accelerate Innovation

Accelerate account opening, KYC/AML checks, and payment processing. Differentiate your FinTech solution in a competitive market.

Specialized services

Create custom automations for your specific financial challenges, from managing wealth to optimizing customer service.

Automate Any Financial Process with Your Data

Elementum helps teams like yours do more with their data. Here are a few examples:

Client Onboarding

Onboard clients up to 6x faster by automating all manual validation checks that typically lengthen and identify bottlenecks.

Market Data Management

Optimize subscription costs with ML-driven workflows that automatically identify, reclaim, and renew the right subscriptions.

Automated Cashflow Reporting

Shorten reporting cycles and improve forecasting accuracy with automated monthly, quarterly, and annual variance analysis.

Category Spend Management

Proactively manage category spend with workflows that reconcile POs, apply proper classifications, and address anomalies like restricted vendors, incorrect prices, and high-risk categories.

Purchase Order Exceptions

Streamline purchase order processing by automatically identifying and resolving exceptions such as missing approvals, incorrect pricing, or vendor discrepancies.

RFP Security and Sentiment Analysis

Automate RFP responses with AI-powered tools that analyze open-ended questions, generate security and sentiment scores, and provide insights for more informed decision-making.